Are Palace a good investment?

I get the impression that most football fans think owning a club is a good investment . So let's compare share price increase through the years against the market (S&P 500).

I get the impression that most football fans think owning a club is a good investment and would bring in lots of money as the Premier League is very successful. While football clubs are high profile they don't bring in much profit. Last season only one Premier League team made an operational profit (Profit before adding players’ sales and other one-off items). And only four teams made an actual profit. Palace hasn't released a dividend at any point. So an investor's main way they can make money is by selling their shares for high amounts. So let's look at Harris and Blitzer’s investment; if they had sold out at other times when new shares had been issued. Suppose they had sold their shares for the price of the new shares would they have made much money?

Dayjob

It’s worth adding Harris and Blizters day job. Blizters works for Blackstone and Harris was a joint founder of Apollo Global Management. What do those companies do? They invest the money of other companies. My last workplace pension was Scottish Widows. The fund that my workplace pension was buying into on my behalf. What they do is spend that money to create more money. If you left it wouldn’t grow as needed for a pension to work as I need the money to grow so I can retire. Below is an example of my Scottish widow’s holdings. Blackrock is the main fund that funds this pension to pump money into. They are 6th largest investment company by market cap rivals to Blackstone (7th) and Apollo (13th). It’s not just pension funds that invest in funds, it’s banks, insurance companies, sovereign wealth funds, and so on.

Got a bit sidetracked there but Harris and Blizter’s world is investments. They are big players in that world. So let’s look at how much their investment in Palace has done compared to the market.

Standard and Poor's 500 index fund

S&P 500 companies on average grow ten percent every year for the last thirty years. Which makes my pension growth look rubbish. From the outside as a non-investment person, this doesn't seem to take too much to manage. It's a list of the biggest 500 American companies. This is buying a stake in the market and not trying to beat the market. Sense checking the companies to make sure that you're not investing in a dud. Having a finger in every pie is referred to as an index fund. Buy and sell the companies going onto and off this list. This is often used as a benchmark to see if you have beaten the market. I am using the numbers from Vanguard S&P 500 ETF for the calculations later on.

Thirty percent of the recent growth is down to seven companies. The magnificent 7 (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla, and Meta Platforms). This often is the case that top companies have most of the growth. So why wouldn't you just invest in them? That's the skill as it’s not easy to predict which companies will be the top companies in the long term. So index fund is a shotgun method. You get some hits if you invest in everything.

Initial investment

In December 2015, Palace Holdco was set up with A and B-type shares worth £82.7m. There were also £10m preference shares that I will ignore as they haven't had any new shares issued, so the value hard to tell and I am going to assume they are still worth £10m. I am going to use the USD value of those shares as a starting point. As that is their home currency. Using the exchange rate at the time works out to be $150 per share.

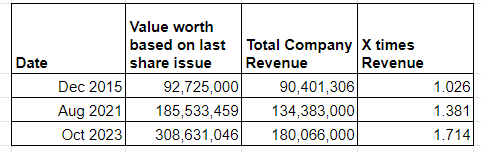

The August 21 was the share issue for Textor’s initial investment. This was for £87.5m for 740,221 shares. This prices the shares at £118.20 per share. Up £18.20 per share from 2015. That sounds ok it’s only 17% over 6 years. That’s an average of 3% each year which is close to inflation at the time. This is not their home currency. As they are Americans, it better reflects how much an investment has done if you view it in your home currency. Harris and Blitzer's share price in USD for initial investment was $150.96. Since their initial investment sterling lost a lot of value. The price per share on Aug 21 was $163.12.

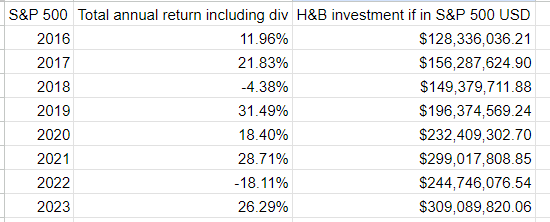

If they had just put that money into an S&P 500 index fund. So back at the start of 2016 put $128m it would have been worth $277m. They would have nearly doubled their money. Palace isn’t the only pie they have their fingers in, and I am sure wealth has increased by similar amounts. Bloomberg has Harris’s wealth a year ago at $7b and now is $10b. Bloomberg won’t know the actual figures but it gives you a rough guestimate.

That’s not the only share issue. Last year £31 million worth of new shares were issued. This brings up the USD price up to $215. This share issue adds 10% more shares. Yet the price went up compared to 21. If Harris and Blitzer put their money in the S&P 500 it would have grown 140%. There Palace shares increased 70%.

Between Textor’s two share issues. The price has gone up faster than the market. The shares in 19 months shares went up $51. At the same time, there was a drop in the market of 18%. Either the year before or after had a gain of over 25%. Part of the reason financial advisors like you to have an emergency fund as you don’t want to be forced to cash out while in decline.

Recently Textor has interviewed with the athletic and mentioned he is looking for 4 to 6 times revenue. A common way of valuing a company is going by X times profit. X is often determined by industry. Super rough but is handy as you can compare recent deals with companies in similar industries that are different sizes. So four to six times is £720m to £1.08bn. Based on the share issue on March 23; The shares were issued at 176.75. That values the company at £340m. That would be 1.8 times the revenue. A year and a bit later, he is after 4x revenue. On the other hand, he’s got Raine Group looking for a buyer. They got more than I thought possible for Chelsea and Manchester Utd. They are high end so I wouldn’t thought they take on the work if they didn’t think it was possible.

Textor wants full control to integrate Palace more with the other clubs. I think he would be more active at buying and selling players than Parish. I feel that Parish wants to hang on and keep the best players for as long as he can by giving them large contracts like with Zaha. When he mentions risk that is what he is getting at.

In the interview, he mentions Everton to get attention. More people to see that he wants to sell. Especially overlaps between people who might want a stake at Everton and people who would like to buy his stake at Palace.

I guess that Harris and Blitzer would buy him out at close to the share price from March 23. As at the time they agreed to that price. When you issue shares, you dilute your stake at the club and add cash to the club. Major shareholders would have to agree before they can be issued.

Greg Bettinelli on the price of football mentioned that teams are closer to Europe than relegation would have values 3x to 10x of revenue. Also, teams that are closer to relegation have 1x to 2x of revenue. He included Palace in the 3 to 10 group but may just being nice. If you look below Palace has been in the 1 to 2 group. But to be fair at those points at the time I would consider Palace to be closer to relegation especially the Textor’s first season as there was a busy summer transfer window. Also back then Zaha was key and if he had a bad injury it could have put Palace into a real relegation struggle.

Why put money into Palace?

I don't think it was for money in Harris and Blitzer's case. It's not like they wanted to waste and lose money. Just that so many easier and less time-consuming ways of making money. It’s about being a part of the decision-making process and enjoying being in charge. Maybe they enjoy the profile that comes from being involved in a sports team. If they are at a networking event; with investors of their funds then it’s very easy small talk to mention the sports teams. I think it’s just a hobby.

Textor

With Eagle Holdings it's different. The holding company aims to get into the NY stock exchange. That would be a difficult task. Since his original investment of £118 per share ($163.12). The share price paid on Oct 23 was £176.75 per share ($215). If you put the price of one share into an S&P 500 fund then it would have from £163.12 to $184.83. So far he is beating the market with his investment. This is mainly due to an 18.11% decrease in 2022 in the market. Compounding of the investment takes time. So index funds over a short time might not be great. Part of the reason when financial advisers like you to have an emergency fund before you start investing as you don’t take a crash out at the wrong time due to needing cash but in the long term the investment will be larger.

Back when I first started blogging I found a Bloomberg interview where Harris said something along the lines that Palace is an interesting thing to own. He mentioned it would have few percentages of growth and not investment he would advise. Blitzer has money in FC Augsburg; a German Bundesliga club. That club is owned 50% by the fans. Anyone putting money into German football it's likely to be more about being involved than profit as a motive.

Buy on the rumour and sell on the news

The football landscape is very different when Textor puts his money compared to Harris and Blitzer. There is more dominance in the Premier League and Champions League in terms of generating cash. If the Swiss Model increases income the top clubs become even more wealthy. Then will be plenty of large fees from the top teams and Eagles holding can earn money from top fees. The Palace and Lyon can generate cash by finding the best players for the extremely rich clubs and also getting Premier League and Champions League money. Lyon as one of the biggest clubs in France should be getting into the Champions League regularly. The aim of this project is to get listed on the stock exchange and maybe get added to the index. They will cash out at the point it becomes news to get the most return.

Conclusion

Putting money into Palace won't get you similar returns to the market so far. While the value of the Palace will increase but market has increased more. Unless they can change the status of the club to a regular in Europe competition. That would increase revenue but more importantly, it changes the multiple that shares can be sold for. The market should double every ten years on average. If you can go from 2x to 8x. Would be like twenty years of growth average market growth. You can say that Leicester City and West Ham are teams that both have changed their status for a while. But Leicester has been relegated recently. I am not sure a club like Palace can change their status to get the higher multiples as one bad season; then it’s back to the Championship like other Premier League mainstays Stoke/Wigan/Leeds/Wimbledon.